We share verified earning schemes daily on Telegram.

In our Telegram channel, you'll find crypto signals, insider info on HYIPs, combo deals for tappers, and coin giveaways. Only verified earning methods without fluff.

In this article, we will discuss the main indicators of the cryptocurrency market such as liquidity, volume, and volatility, as well as the concept of open interest. This information will help you understand the relationship between sellers and buyers as expressed in statistical form. These indicators determine in which direction and how quickly the price of an asset changes.

Market Characteristics: Volume, Liquidity, Volatility

Liquidity is the combination of the speed at which new trades appear, the volume of orders, the size of positions, the number of orders and trades, as well as the number of participants. If these parameters are relatively high, then the pair you have chosen is liquid and you can trade it comfortably.

What does the concept of liquidity mean in practice? Liquidity allows you to understand what amount and on which pair you can enter an asset, as well as determine a strategy for accumulating or selling a large position. If the liquidity of a pair is too low, even a small purchase amount can cause an involuntary "pump", as a result of which other participants will "offload" their reserves onto you. The outcome of such a trade will be an initial loss at the moment of your purchase, since your average entry price will be de facto higher than the market price.

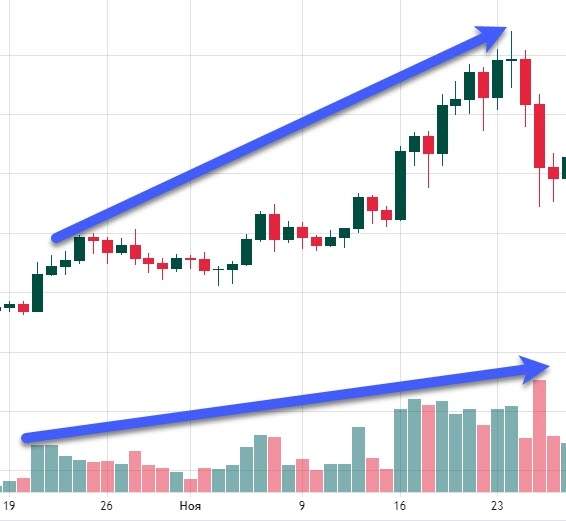

Market volume is the total amount of trades made over a certain period of time. A red candle on the volume indicator in TradingView means sales dominate, a green one means purchases dominate.

Let’s consider two examples of volume analysis:

- Market volume increases, which means traders’ interest in the asset is rising and sharp price changes are observed in one direction or another.

- Trading volume drops to a minimum – a consensus is reached between buyers and sellers, and soon a breakout from accumulation to the upside is likely.

Volatility is the maximum change ("fluctuation") in price over a selected period of time.

The main advantage of the cryptocurrency market is high volatility, which allows for “short-term” trades with high potential profit (and losses, he-he;)).

Open Interest

Open interest is calculated by adding all contracts from open trades and subtracting contracts when a trade is closed. There is no difference between long (buy) and short (sell) positions when calculating open interest; contracts for both are summed. Only contracts from closed positions are subtracted. As current positions are closed, open interest decreases.

Open interest and volume are interrelated concepts, but the key difference is that volume counts all contracts that have been bought and sold, while open interest only counts those contracts that remain open on the market.

Open interest is used as an indicator to determine market sentiment and the strength of price trends:

- An increase in open interest is a sign confirming a bullish trend.

- A decrease in open interest confirms a bearish market.

- The impact of price, volume, and open interest on the market

- If price rises, volume rises, and open interest rises – there is a strong uptrend, which contributes to further price growth.

- If price rises, volume falls, and open interest falls – a bearish trend is approaching – the current uptrend is weakening.

- If price falls, volume rises, and open interest rises – the bearish trend continues.

- If price falls, volume falls, and open interest falls – the bearish trend is weakening, and a reversal is near.

You can view open interest data on Binance (link).

Conclusion

Let’s summarize the two main conclusions for this lesson:

- Analyzing volatility and liquidity allows a trader to determine the asset in which price fluctuations are large enough for them to safely apply their trading strategy without harming themselves or other market participants.

- Open interest represents the number of futures contracts and characterizes the strength of the current trend.

Thank you for your attention!

Information

Users of Гости are not allowed to comment this publication.