We share verified earning schemes daily on Telegram.

In our Telegram channel, you'll find crypto signals, insider info on HYIPs, combo deals for tappers, and coin giveaways. Only verified earning methods without fluff.

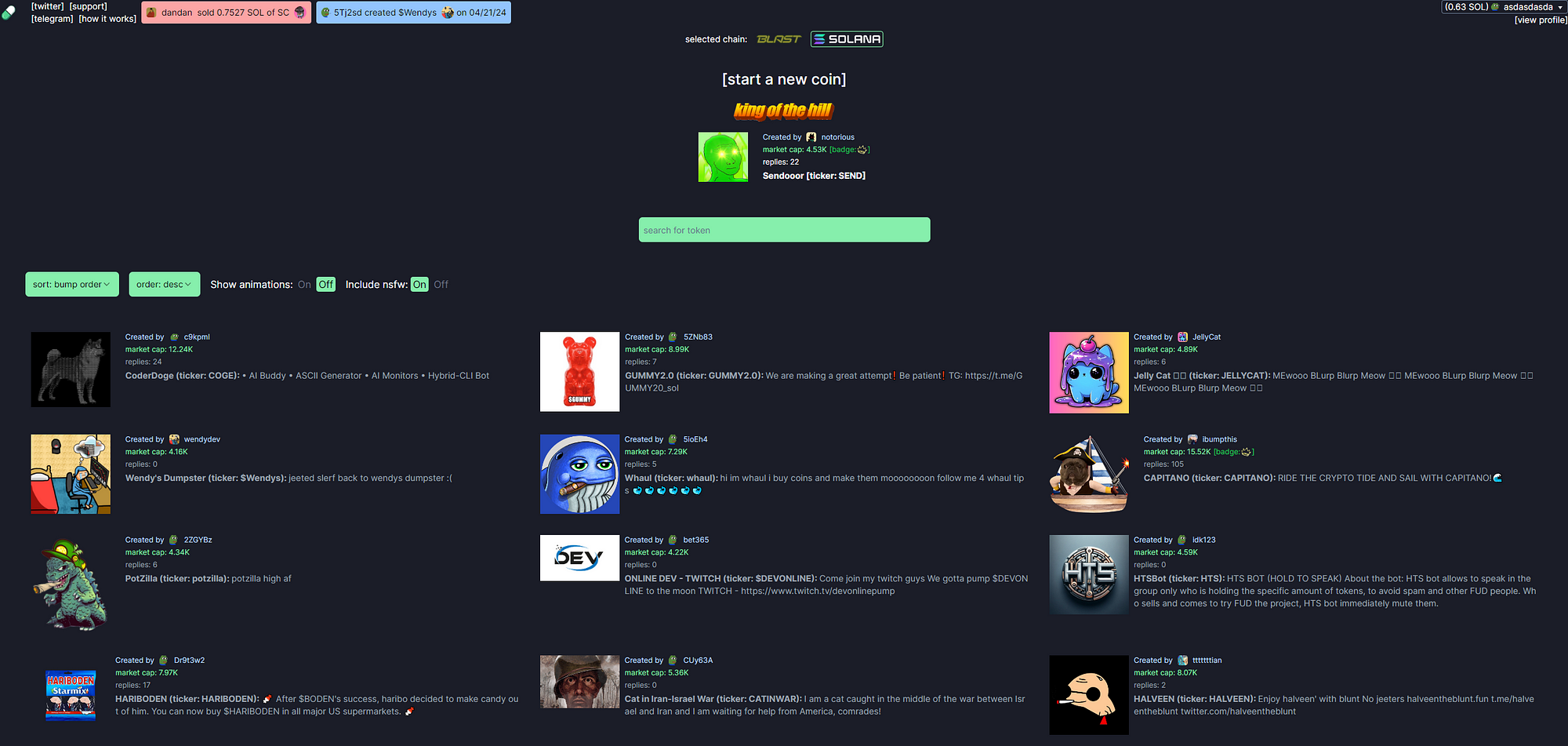

Pump.fun burst onto the crypto scene in January 2024, becoming a true phenomenon in the world of memecoins. This platform, operating on the Solana and Blast blockchains, allows anyone to launch their own token with just a few clicks. Unlike "serious" cryptocurrencies, memecoins live by the laws of internet culture and often skyrocket in price due to viral trends or catchy names.

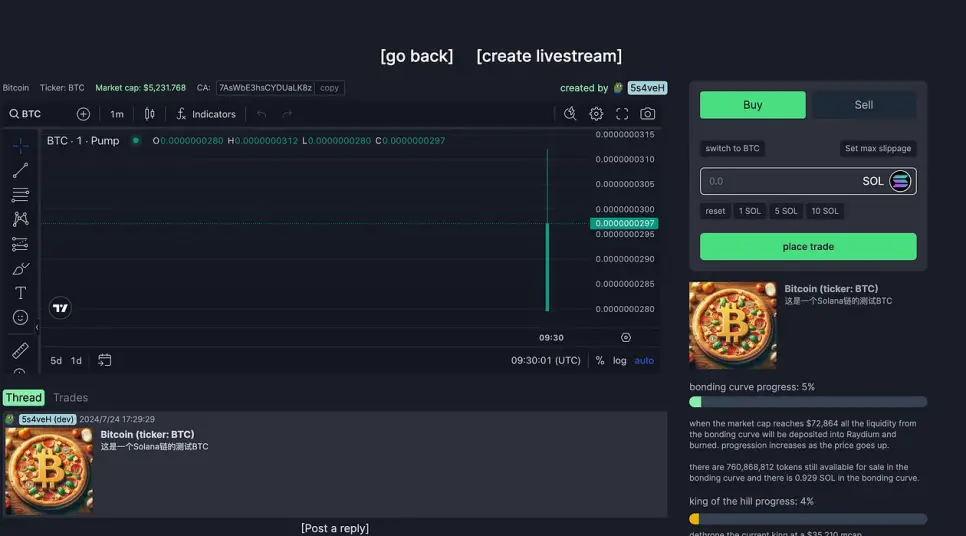

At the core of Pump.fun lies the bonding curve model - a mathematical algorithm that automatically adjusts the token price based on demand. Simply put, the more people buy a token, the higher its price becomes. Conversely, during mass sell-offs, the price drops. This creates a dynamic market where prices constantly fluctuate wildly.

The uniqueness of Pump.fun is that there are no traditional order books or trading pairs. Instead, each token is traded against the blockchain's base currency - SOL for Solana or ETH for Blast. This significantly simplifies the trading process and makes it more understandable for newcomers.

The platform supports multiple blockchains, giving users a choice. For example, Solana is known for its speed and low fees, while Blast attracts with innovative features. As of August 2024, over 2.4 million tokens have been created on Pump.fun, indicating the platform's immense popularity.

One of the key features of Pump.fun is automatic listing on decentralized exchanges (DEXs). When a token's market capitalization reaches $69,000 for Solana or $420,000 for Blast, it is automatically listed on Raydium or other popular DEXs. This opens the door for the token to enter the "big world" of crypto trading.

Pump.fun uses an unusual approach to liquidity. When certain market cap thresholds are reached, a portion of the token's liquidity is automatically burned. This can lead to sharp price spikes and creates additional excitement for traders.

It's worth noting that despite its apparent simplicity, trading on Pump.fun requires a serious approach. Prices change here at lightning speed, and an inexperienced trader can easily lose all their funds in a matter of seconds. The platform offers no guarantees of success, and most tokens created here quickly lose value.

Pump.fun has become a true phenomenon in the crypto world, spawning an entire culture of "meme" investors. Here you can find tokens with the craziest names and concepts - from "CatDog" to "MoonCheesecake". Some of them become sensations, while others disappear without a trace.

In July 2024, Pump.fun even surpassed Ethereum in daily revenue, collecting $2 million in fees in a single day. This shows just how popular the platform has become among crypto enthusiasts.

How to Create Your Own Memecoin on Pump.fun?

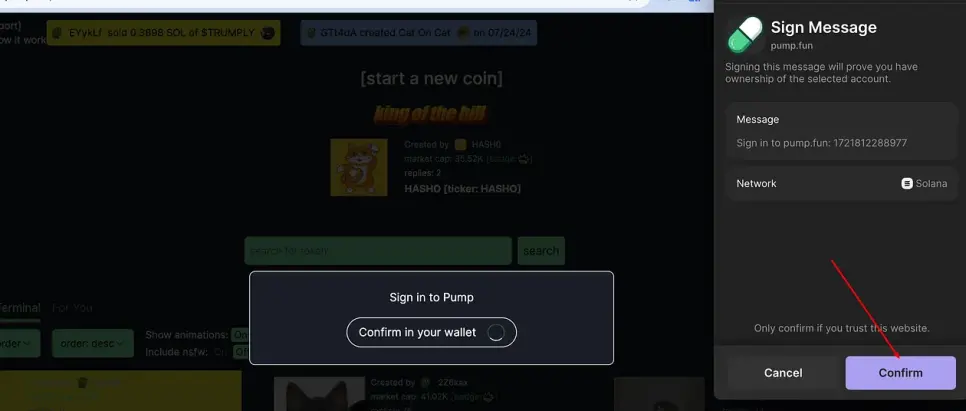

Creating a memecoin on the Pump.fun platform is a simple process accessible to everyone. To begin, you need to connect a crypto wallet compatible with the Solana network, such as Phantom or Solflare. Once you've successfully connected your wallet, you can proceed to create your token.

The name of your memecoin is 50% of its success. It should be as catchy as a fisherman's hook. For example, "DogeMoon" with the ticker "BARK" will instantly attract dog and space enthusiasts. While "CryptoTaco" with the ticker "SALSA" will make even the most serious traders smile.

The next step is determining the total token supply. Here you can go wild, from a few thousand to trillions. A large number of tokens creates an illusion of cheapness, which can attract small investors eager to become "whales".

The image for your memecoin is its face in the digital world. It should be as bright as a neon sign in Las Vegas and as memorable as the Apple logo. A high-quality image can go viral and spread across all social networks faster than news of a Bitcoin crash.

Previously, launching a token for trading required a minimum liquidity of $2. That's pocket change compared to other platforms where launching can cost as much as a used car. However, in August 2024, Pump.fun did the impossible - token creation became free!

Now, the fee of 0.02 SOL (about $2.55 as of September 2024) is paid by the first buyer of the token. It's as if the first customer in a store paid for the rent of the premises. Sounds crazy, but it works!

But that's not all. Pump.fun introduced a reward program for token creators. Now you can receive 0.5 SOL (about $80) when your token reaches a certain activity threshold. This is called "completing the bonding curve" - a term that might make newcomers' heads spin.

In simpler terms, if your memecoin becomes popular enough and reaches a market cap of $63,000, it automatically gets listed on the decentralized exchange Raydium. It's like winning the lottery, except instead of random numbers, you're relying on the power of memes and your creativity.

After filling in all the fields and confirming the transaction, your memecoin instantly appears on the platform, ready for trading. But remember, the success of your token depends not only on a funny name and a bright picture. You need to actively promote it on social media, build a community, and maintain investor interest.

Pump.fun for Dummies: How to Make Money on Memecoins Without Losing Everything

Trading memecoins on Pump.fun is a rollercoaster ride for your wallet. The platform operates on the Solana blockchain, renowned for its lightning-fast speed and dirt-cheap fees. But don't get carried away - you can strike gold in minutes or end up with nothing just as quickly.

Step 1: Preparing to Jump Down the Rabbit Hole

First, you need to get a Solana wallet. Phantom or Solflare are perfect choices. Install the browser extension and create a wallet. Write down your seed phrase and hide it as if it's a treasure map - lose it, and your crypto millions will turn into a pumpkin.

Now fund your wallet. Buy SOL on any popular exchange and transfer it to your new wallet address. A couple of SOL is enough to start - you'll either get rich or lose it all anyway.

Step 2: Diving into the Mad World of Pump.fun

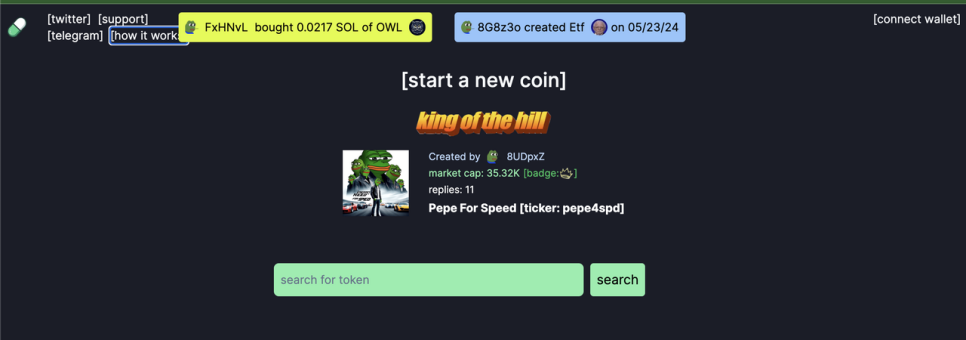

Head to the Pump.fun website. The "Connect Wallet" button is usually hidden in the top right corner. Click it, choose your wallet, and confirm the connection. Congratulations, you're officially in the game!

You'll see a trading terminal - the heart of Pump.fun. Here you'll find price charts, trading volumes, and transaction history. It might look like Greek at first, but don't panic - in a couple of hours, you'll be reading these charts like an open book.

Step 3: Hunting Wild Memecoins

Now you see a list of all available memecoins. Don't rush to buy everything - that's a surefire path to bankruptcy. Look at the charts, read the descriptions. Pay attention to trading volume and market cap - the higher they are, the more actively the coin is traded.

The key feature of Pump.fun is the bonding curve model. Simply put, the more people buy a coin, the more expensive it becomes. For example, if the "MoonLambo" token costs 0.1 SOL, and someone buys it for 1 SOL, the price might jump to 0.12 SOL. And if someone sells for 1 SOL, the price might drop to 0.09 SOL.

To buy, select a coin and click "Buy". Enter the amount of SOL you're willing to risk. The platform will show how many tokens you'll receive. Don't forget about the 1% fee - it can significantly impact your profits if you trade actively.

Step 4: Creating Your Own Memecoin

Want to feel like a crypto god? Click "Start a new coin". Come up with a name (the more absurd, the better), a ticker, and upload an image. Pay a fee of 0.02 SOL, and your coin is ready to conquer the charts!

Step 5: Strategies for Madmen and Geniuses

On Pump.fun, the early bird catches the worm. Early adopters can hit the jackpot by buying tokens at dirt-cheap prices. For instance, the first buyer of "RocketDoge" could have gotten it for 0.001 SOL, and an hour later, the price could skyrocket to 0.1 SOL - that's a 9900% profit!

Here are a few strategies for those who aren't afraid to take risks:

- Sniping: Hunt for new coins, buying them right after launch. The risk is enormous, but so is the potential profit.

- Riding the Hype: Keep an eye on social media. If a memecoin starts gaining traction, try to catch the departing train.

- Scalping: Make multiple small trades on minor price fluctuations. It's tedious but can be profitable.

- Long-term Holding: Choose projects with active communities and hold tokens longer. Sometimes patience pays off royally.

Many traders use bots like Photon to automate trading. These programs can monitor new tokens and execute trades faster than you can blink. But remember - one wrong algorithm, and you'll be left with nothing.

Step 6: Don't Forget About Safety

Pump.fun isn't a stock market; it's a real rollercoaster. Be prepared for both dizzying highs and crushing lows. A token can grow 1000% in an hour and crash 99% in a minute. Just remember "PEPE" - in May 2023, it soared 7000% in a week, then crashed 60% in a day.

Never invest more than you can afford to lose. Use two-factor authentication to protect your account. And most importantly - don't give in to FOMO (fear of missing out). It's better to miss one opportunity than to lose everything on a scam.

Remember that when a token reaches a market cap of $69,000, it automatically gets listed on Raydium DEX. This can lead to a sharp increase in price and liquidity, but it also increases risks.

Pump.fun is like Las Vegas in the crypto world. You can hit the jackpot or end up penniless. But if you approach it smartly and keep your head, you can not only make a profit but also get a ton of adrenaline. Good luck in the world of crazy memecoins!

What security measures does Pump.fun use?

Pump.fun, launched in January 2024, has implemented a series of mechanisms to protect users and ensure fair trading of memecoins. The platform fiercely combats the notorious "rug pulls" (where token creators suddenly withdraw all liquidity, leaving investors with worthless coins).

A key security feature of Pump.fun is its fair launch system. There are no presales, no secret token distributions among the development team. All market participants are on equal footing from the start. It's as if all runners started simultaneously, rather than some starting from the middle of the track.

But Pump.fun doesn't stop there. The platform employs an ingenious automatic liquidity burning mechanism. When a token's market capitalization reaches $69,000 (yes, that exact amount), a portion of the liquidity is automatically burned. In simpler terms, tokens are permanently removed from circulation. It's like a central bank destroying part of the money supply to combat inflation.

Automatic DEX Listing

Pump.fun also uses an automatic listing system on decentralized exchanges (DEXs). When a token reaches a certain market capitalization, it's automatically listed on DEXs like Raydium for Solana tokens. This isn't just a convenience, but a security measure:

- Expands access to token trading

- Increases liquidity (in simpler terms, more people can buy or sell the token)

- Reduces the risk of price manipulation on a single platform

Pump.fun provides users with built-in analysis tools for tokens and their creators. These tools help traders avoid pitfalls by providing data on:

- Token transaction history (who bought or sold, when, and how much)

- Token distribution among holders (checking for overly large "whales")

- Token creator's activity on the platform (to detect potential scam attempts)

However, even Pump.fun isn't without its hiccups. In May 2024, the platform faced a serious incident. A former employee, knowing all the ins and outs, exploited a vulnerability, resulting in a loss of about $2 million. It's as if a former bank guard robbed it, knowing the safe's code.

In response, Pump.fun didn't bury its head in the sand:

- Strengthened internal audit procedures (now every move is scrutinized)

- Implemented additional checks for employees with access to critical systems (no more "trusted insiders")

- Increased the frequency of external security audits (trust, but verify, and then verify again)

Despite all these measures, trading memecoins remains a risky business. Pump.fun never tires of reminding: be cautious, do your own research, and don't invest more than you're willing to lose. In the world of memecoins, even the most robust protection doesn't guarantee you won't end up with an empty wallet and a bitter experience.

What are the risks of using Pump.fun?

Pump.fun, a platform for creating and trading memecoins, attracts users with promises of quick wealth. However, serious dangers lurk behind the bright wrapper.

High volatility of memecoins is the main risk for traders. Token prices can skyrocket 1000% in an hour and crash 90% in 15 minutes. Such roller coasters can empty an inexperienced investor's wallet faster than they can blink.

Low liquidity of most tokens on Pump.fun is another trap. Attempting to sell a large volume of memecoins can crash their price, leaving the trader with losses. This phenomenon is called slippage - when the selling price is significantly lower than expected.

Despite the claimed security measures, Pump.fun remains a paradise for manipulators. Unscrupulous players can artificially pump token prices using multiple wallets and coordinating actions on social media. In May 2024, the platform suffered a serious hack, resulting in the theft of about $2 million.

FOMO (Fear Of Missing Out) is a psychological trap that forces users to make rash decisions. Seeing a rapid price increase, traders often buy the token at its peak, risking losing everything during the inevitable correction.

Lack of regulation in the memecoin sphere means that Pump.fun users are left alone with the risks. In case of fraud or technical failures, there's no hope for compensation.

The closed source code of Pump.fun raises justified concerns. The inability to check the code for vulnerabilities or hidden functions undermines trust in the platform.

Statistics are merciless: only about 3% of users make a profit of more than $1000 trading memecoins on Pump.fun. This means that 97% of traders either lose money or settle for pennies.

It's important to understand: investing in memecoins on Pump.fun is akin to playing Russian roulette with a loaded revolver. The chances of winning are tiny, and the risk of losing everything is enormous.

How to maximize chances of success when using Pump.fun?

Success on Pump.fun requires a careful approach and strategic thinking. Thorough research before investing in memecoins is a key factor. This involves studying the project's history, analyzing its concept, and assessing its growth potential.

Portfolio diversification reduces risks. Distributing investments across several projects is a sensible strategy. For example, dividing capital into 5-10 parts and investing in different tokens on Pump.fun can protect against total loss of funds in case one project fails.

When analyzing the potential of memecoins, pay attention to the following factors:

- Concept uniqueness: assess how much the project's idea differs from existing ones

- Community activity: examine the number of followers on social media and their engagement level

- Token liquidity: check the trading volume and order book depth (list of buy and sell orders)

Technical analysis helps determine optimal entry and exit points. Use price charts and indicators such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) to identify trends and potential reversals. For example, buying at a bounce from a support level can be an effective strategy.

Monitoring social media and crypto communities is crucial for tracking trends. Follow popular hashtags, forum discussions, and sentiments in Telegram groups. This will help you stay informed about new projects and potential "hyped" tokens.

Risk management is an integral part of successful trading. Use stop-losses (orders to sell at a set price to limit losses) to limit losses and limit orders to secure profits. It's recommended to set a stop-loss at 10-20% of the entry price, and a take-profit (order to secure profit) at 30-50%.

Effective use of Pump.fun tools will increase chances of success. Study the platform's functionality, including:

- Token analyzer: evaluate key project metrics

- Activity tracker: monitor popular tokens and trends

- Alert system: set up notifications for important events

To create a successful memecoin on Pump.fun, focus on developing a unique concept. Come up with a memorable name and create an attractive logo. Actively promote your project on social media, using creative content and engaging mechanics.

Understanding the bonding curve model is critical for making informed decisions. This model determines how the token price changes depending on its supply. On Pump.fun, the price grows exponentially as the number of tokens in circulation increases.

Emotional control and discipline are key factors for success in memecoin trading. Don't succumb to FOMO (fear of missing out) and don't make decisions under the influence of emotions. Set clear rules for entering and exiting positions and strictly follow them.

Success on Pump.fun requires constant learning and adaptation to the rapidly changing conditions of the memecoin market. Regularly analyze your trades, learn from mistakes, and improve your strategy.

Information

Users of Гости are not allowed to comment this publication.